Calculating the Fair Value of an Investment Using the Discounted Cash Flow Method

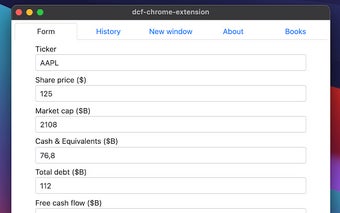

This extension will come in handy for investors in evaluating investment opportunities. Using the discounted cash flow (DCF) method, this extension calculates an investment's fair valuation.

It helps to understand the value of the investment for an investor, based on the expected future cash flow.

As a result, the value of the investment is adjusted for the time value of money.

The reason for choosing the discounted cash flow method is that it takes into account the time value of money.

What is DCF?

DCF is a method that allows you to calculate the present value of an investment using the expected future cash flow.

The method is based on the following assumptions:

An investment is valued today at a certain price

The expected future cash flow

The discount rate.